I was reading a financial advice forum the other day when someone asked a question about tax. A commenter responded, "You shouldn’t be worried—on a salary of £50,000, you’re only paying about 20% tax."

This statement, while not entirely false, reflects a common misunderstanding of taxation in the UK. The UK tax system is often confusing, and whether by accident or design, it frequently obscures the true tax burden on individuals.

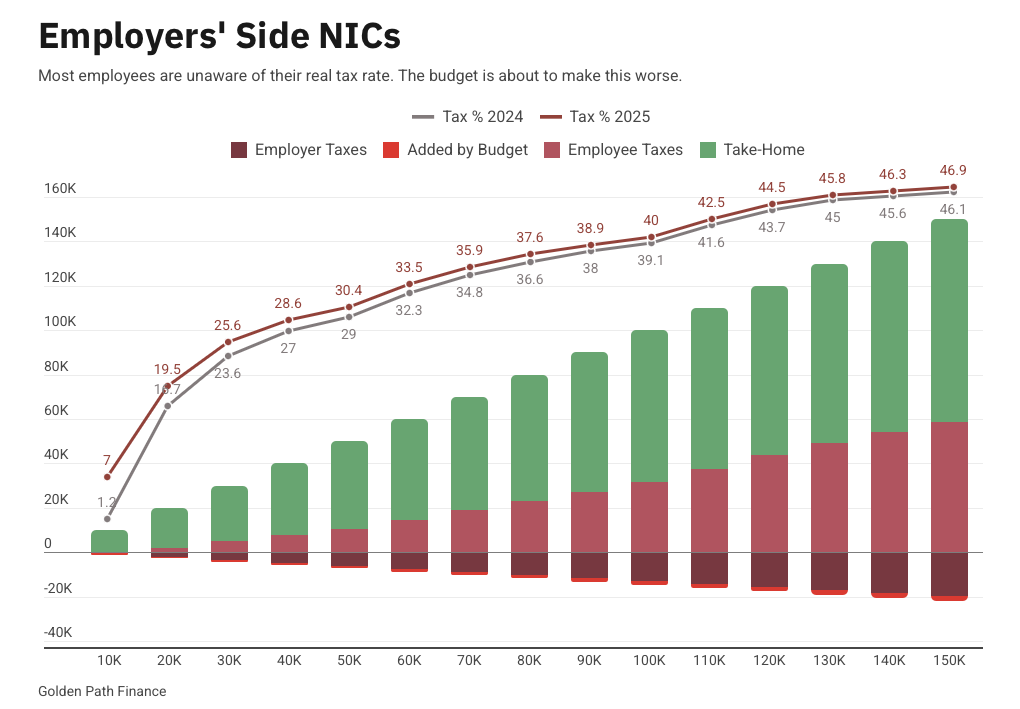

At first glance, someone earning £50,000 will see around 20% of their salary deducted in Income Tax and National Insurance (famously marketed as "not an income tax, but a tax on income"). However, this calculation overlooks a significant additional cost: the employer’s contribution to National Insurance.

Employers are required to pay an extra £5,644 in National Insurance Contributions (NICs) for an employee earning £50,000. Although this money never reaches the employee’s payslip, it is still a direct cost of employment. When factoring in this hidden tax, the government’s share of the total employment cost rises to nearly 30%.

From an employer’s perspective, what truly matters is the total cost of employing someone—not how it is distributed between salary, tax, and benefits. In reality, the burden of employer NICs ultimately falls on the employee, because it limits their potential earnings. If employer NICs were abolished tomorrow, salaries would likely rise proportionally to compensate.

This phenomenon can also be seen in property transactions. Buyers are typically responsible for Stamp Duty, yet if it were removed, house prices would immediately adjust upward. The buyer’s overall cost wouldn’t change, but sellers would benefit from capturing the value previously lost to tax. Similarly, employer NICs reduce potential wages, even though they appear to be a cost borne by businesses.

The recent increase in employer NICs has further exacerbated this issue. For instance, a business hiring a part-time worker on £10,000 previously paid £124.80 in employer NICs. From the next tax year, this will jump to £749.40—a sixfold increase.

For an employee earning the national average salary of £37,430, if the increase had not occurred, employers could have raised their salary to £38,268 at the same total cost. But with the additional tax burden, businesses will struggle to offer salary increases, leading to stagnating wages.

At higher income levels, the effect is even more pronounced. For someone earning £150,000, nearly 47% of their total employment cost goes to the government. This reality is often hidden behind misleading distinctions between "employee" and "employer" taxes, creating the illusion of a lower-tax economy than actually exists.

Ultimately, the way we discuss taxation matters. The more we accept these artificial divisions, the easier it becomes for policymakers to raise taxes without scrutiny. Understanding the full picture is the first step toward having an honest conversation about the true cost of taxation in the UK.

How This Relates to Financial and Retirement Planning

Understanding the true tax burden is crucial for financial and retirement planning. Many individuals calculate their future savings and investments based on their take-home pay, without considering the full cost of employment and how taxation impacts long-term financial goals.

For example, when planning for retirement, it’s essential to factor in not only personal taxes but also employer contributions that affect overall earnings. Pension contributions can be a tax-efficient way to save, as they reduce taxable income, and in some cases, employers will pass along their National Insurance savings from salary sacrifice schemes back to employees, increasing the benefit. Additionally, those earning higher salaries should be aware of thresholds where tax rates increase sharply, as these can significantly impact long-term savings.

By taking a holistic view of taxation, individuals can make better-informed decisions about salary negotiations, pension contributions, and investment strategies. Accurate financial modelling requires a full understanding of both visible and hidden taxes to ensure that future financial security is not underestimated.

Take Control of your Finances

Want to see how employment taxes impact your earnings and financial future? Start by using our simple tax calculators to get a clearer picture.

When you're ready, take the next step with our financial planning tool, and start building a smarter strategy for your future.